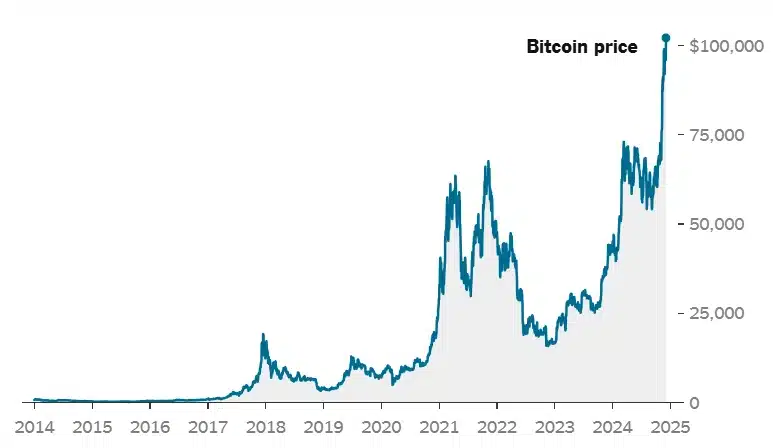

The cryptocurrency world is buzzing with excitement as Bitcoin, the world’s first decentralized digital currency, hit an extraordinary milestone, crossing the $100,000 mark for the first time.

This achievement represents a pivotal moment in Bitcoin’s 16-year history, transforming from an experimental digital asset into a mainstream financial powerhouse.

Below, we analyze the key developments driving this surge, explore the broader impact on the financial landscape, and assess potential risks and opportunities for investors.

Bitcoin’s Meteoric Rise: Key Drivers Behind the Surge

- Political Support for Crypto

The recent election of U.S. President-elect Donald Trump, a vocal supporter of digital assets, has significantly boosted market sentiment. Trump’s appointment of Paul Atkins, a known advocate for crypto-friendly policies, as the next chairman of the SEC has further fueled optimism in the crypto community.- Atkins’ history with regulatory reform aligns with industry calls for clearer, more accommodating rules.

- Trump’s campaign promises, including creating a strategic Bitcoin reserve and positioning the U.S. as a global crypto leader, have strengthened investor confidence.

- Wall Street’s Embrace of Bitcoin

Bitcoin’s integration into traditional financial markets has played a pivotal role in its growth. Major Wall Street firms, such as BlackRock and Fidelity, now offer Bitcoin-linked exchange-traded funds (ETFs), attracting billions of dollars in institutional investments.- The approval of Bitcoin ETFs has democratized access to cryptocurrency, making it more accessible to retail investors.

- Bitcoin’s market capitalization now exceeds $2 trillion, surpassing giants like Mastercard and JPMorgan Chase.

- Resilience and Recovery

After a tumultuous 2022, where Bitcoin’s value plummeted below $17,000 due to the FTX exchange collapse, the cryptocurrency has made a remarkable recovery. This resurgence highlights Bitcoin’s resilience and its growing acceptance as a legitimate asset class.

Implications for the Financial Ecosystem

Opportunities

- Diversification and Wealth Creation

Bitcoin’s rise has cemented its role as a high-growth investment option. Early adopters and institutional investors have reaped substantial rewards. For instance, Michael Saylor’s company, MicroStrategy, now holds Bitcoin assets worth over $30 billion, showcasing the wealth-building potential of crypto. - Mainstream Adoption

The growing participation of Wall Street firms and the proliferation of Bitcoin ETFs indicate a shift in perception. What was once considered a niche investment is now viewed as a viable store of value akin to gold. - Policy and Innovation

Crypto-friendly leadership in regulatory bodies like the SEC could pave the way for innovation and adoption, fostering a more robust ecosystem for blockchain-based technologies.

Risks

- Regulatory Uncertainty

While Atkins’ appointment signals a pro-crypto stance, regulatory clarity is still evolving. Policy changes could create volatility or impact Bitcoin’s long-term viability. - Environmental Concerns

Bitcoin’s energy-intensive mining process remains a contentious issue. Critics argue that its carbon footprint is incompatible with global sustainability goals. - Market Volatility

Despite its growing acceptance, Bitcoin remains a volatile asset. Price swings driven by global economic conditions or sudden regulatory shifts could deter risk-averse investors.

Key Takeaways

- Bitcoin’s Rise to $100,000: Reflects its evolution from an experimental concept to a key player in the financial world.

- Political and Institutional Support: Trump’s pro-crypto policies and Wall Street’s adoption have driven renewed interest and investment.

- Opportunities and Risks: While Bitcoin offers unparalleled growth potential, it also presents challenges such as regulatory uncertainties and environmental concerns.

Long-Term Outlook: What’s Next for Bitcoin?

Bitcoin’s milestone achievement is not just a celebration of past successes but a stepping stone toward broader adoption and integration.

If current trends continue, cryptocurrency could play a central role in the global financial ecosystem, potentially reshaping how we view money, investment, and regulation.

For investors, the road ahead presents both opportunities and risks. Diversification, cautious optimism, and staying informed about regulatory and market developments will be key strategies for navigating this exciting new era of digital finance.

Bitcoin’s journey from a digital oddity to a $100,000 asset underscores the transformative power of innovation and market dynamics.

Also, Read | Wipro’s 14th Bonus Issue: How It Transformed Shareholder Wealth

Also, Read | MapMyIndia’s Strategic Shift: What It Means for Investors