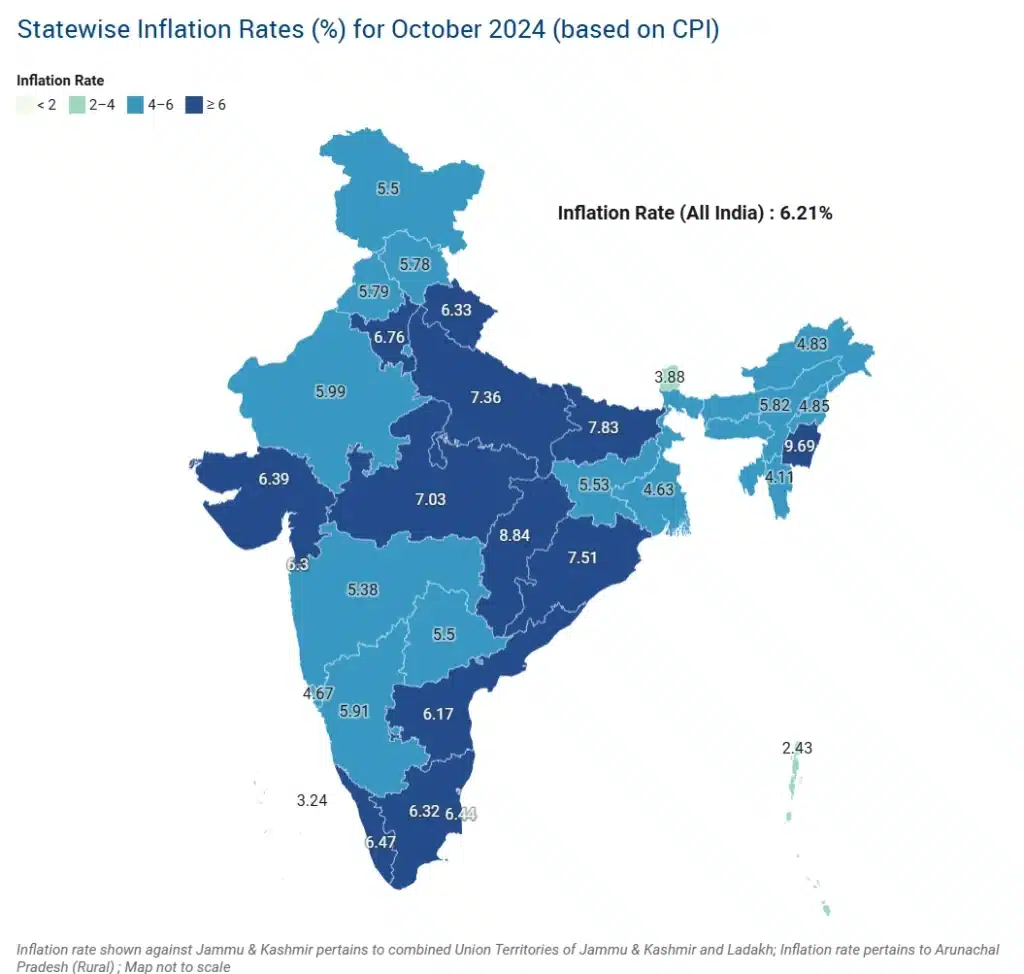

India’s retail inflation spiked to a 14-month high of 6.2% in October 2024, driven primarily by soaring food prices, especially in key vegetables like tomatoes, onions, and potatoes.

This inflation level exceeded the Reserve Bank of India’s (RBI) target range, raising concerns about potential delays in anticipated interest rate cuts.

These rising costs could weigh heavily on purchasing power and profitability for consumers and businesses, affecting overall economic growth in Asia’s third-largest economy.

Key Takeaways

- Inflation Rate: October retail inflation reached 6.2%, exceeding RBI’s 2%-6% tolerance range and marking a significant increase from September’s 5.5%.

- Food Price Surge: Vegetable prices skyrocketed, with tomatoes leading at a 161% inflation rate.

- Impact on Rate Cuts: The RBI’s Monetary Policy Committee (MPC) is now less likely to cut interest rates in December.

- Growth Outlook: Despite inflation, some positive signs emerged in industrial production, hinting at modest economic resilience.

What’s Driving the Inflation Spike?

The surge in inflation is primarily attributed to the rising cost of food, which has consistently pushed up retail prices over recent months.

Data from India’s National Statistical Office shows that food inflation alone jumped from 9.2% in September to 10.9% in October.

- Key Drivers: The “PAT” trifecta—potatoes, onions, and tomatoes—experienced sharp price hikes:

- Tomatoes: 161.3% inflation in October, up from 42.9% in September.

- Onions and Potatoes: Both also rose, though more moderately.

- Additional Pressure: Edible oil prices, another staple in the Indian diet, climbed from 2.5% inflation in September to 9.5% in October.

Given that food items weigh 39% in the Consumer Price Index (CPI) basket, this sector’s inflation has an outsized impact on overall retail prices.

Implications for Interest Rates

1. Delayed Rate Cuts by the RBI

Earlier, there was some optimism that the RBI might reduce interest rates by December.

However, with inflation breaching the upper limit of the RBI’s target, the MPC is likely to hold off on any rate adjustments until inflation shows consistent signs of moderating.

- MPC Stance: The MPC previously shifted from a “withdrawal of accommodation” stance to “neutral,” signaling a potential openness to rate cuts. But with inflation exceeding expectations, they’re likely to adopt a cautious approach.

- Governor’s Perspective: RBI Governor Shaktikanta Das has emphasized the importance of controlling inflation warning against premature rate cuts that could destabilize price stability.

2. Impacts on Households and Businesses

High inflation typically erodes purchasing power, making it more challenging for households to cover daily expenses and pay for essentials.

With the central bank unlikely to cut rates, households will likely have to manage higher monthly loan payments, impacting discretionary spending.

- Consumer Spending: Inflation pressures could dampen demand, particularly in urban areas where growth momentum is slowing.

- Corporate Earnings: Businesses may see squeezed margins as input costs rise, especially in sectors reliant on agricultural produce, impacting profitability and investment decisions.

Positive Signs: Industrial Production Shows Resilience

In an encouraging development, India’s Index of Industrial Production (IIP), which tracks the production in key industries like mining, manufacturing, and electricity, grew by 3.1% in September after contracting by 0.1% in August.

This growth suggests some resilience in India’s manufacturing sector, despite inflationary headwinds.

- Manufacturing Recovery: The manufacturing sector, which forms a significant portion of the IIP, expanded by 3.9% in September, up from 1.8% in August.

- Consumer Goods Rebound: Growth in consumer goods also picked up from a 0.5% contraction in August to 3.9% in September, suggesting that demand in these areas may be stabilizing.

Outlook: What’s Next for India’s Economy?

The path forward will likely involve a delicate balance between managing inflation and supporting growth. Here’s a look at what could unfold:

- Food Inflation Easing: The RBI is optimistic that food inflation could ease in the coming months with the arrival of fresh harvests from the kharif and rabi crop cycles.

- Revised Growth Projections: Although the RBI maintains a GDP growth forecast of 7.2% for 2024-25, private economists are more cautious, with some predicting growth closer to 6.8% amid signs of weakening urban consumption.

- Core Inflation: While food prices remain volatile, core inflation (excluding food and fuel) came in at 3.65% in October, marking the highest level since January 2024. This suggests that non-food prices, while relatively stable, may still contribute to future inflationary pressures.

Bottom Line

India’s inflation spike underscores the need for careful economic management to balance growth and price stability.

As the RBI prepares for its next policy meeting, all eyes will be on food prices and whether the forecasted easing materializes.

In the meantime, households and businesses alike may need to brace for continued high costs as the country navigates an uncertain inflationary environment.

For the RBI, the primary task will be to keep inflationary “horses” in check, maintaining stability without compromising the momentum needed for sustainable growth.

Also, Read | Relaxing Spending Limits Amid Slower Economic Growth